“It may be that there is a simple macro fact that the Treasury market being so much larger than it was even a few years ago… that the sheer volume there may have outpaced the ability of the private market infrastructure to support stress of any sort there… There is thus an open question about whether there will be an indefinite need for the Fed to participate as a purchaser to support market functioning.”

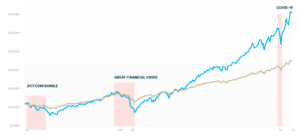

Translation: The Fed might be giving itself another mandate: order and stability in US Treasury markets. Of course, many market participants have already guessed as much. When you factor in its other “new” and unspoken mandate of making sure that the Federal government can fund its massive fiscal spending spree at low rates, this all means that any sharp (too fast) or prolonged (too much) rise in yields will be met with Fed action. It still looks like 0.5% and 1.5% is the trading range for the 10-year established by the current crisis. Of course, yields are moving higher primarily (but not solely) because economic growth prospects are improving which is wonderful. Equities are handling this rise in yields quite well, so far. Of course, we’ll only kn

ow how much is too much when equities take a hit, but the spectacular earnings season we just had suggests that equities can probably stomach a 10-year up to 2% given 2022 forward EPS guidance.

On October 27, the People’s Bank of China altered the fixing regime on the renminbi to a more market-driven and flexible exchange rate. Why is this important? Because it is one more step in its inexorable move toward being widely held as a reserve currency. The dollar and euro may soon be sharing the stage with the People’s Currency.

Miguel Marino

Miguel Marino is the Head of Branding & Technology at Insigneo. He is responsible for the brand’s image, marketing content and technology innovation. Miguel has had an eclectic career in various industries including advertising, information security and social gaming.